Every seller on the internet requires a reliable tool to receive and manage payments. Having either a merchant account, a payment gateway, or a payment service provider is very important.

Sometimes, various businesses tend to face a dilemma in choosing which option is the most appropriate for them. Read on to find out the characteristic peculiarities of a merchant account vs. a payment gateway, and in what scenario would they suit you the best.

What is a Payment Gateway?

A payment gateway is an e-commerce application framework that allows credit card purchases for online retailing, e-commerce, and conventional brick and mortar transactions. Customers enter their credit card information during the checkout process while purchasing products and services from an online store.

The credit card information entered during the checkout process will be sent to the payment gateway, which will approve the transaction and process it. During the processing, the payment gateway checks to see if the customer’s information matches the information on the credit card.

If they are identical, the payment is accepted, and funds are transferred from the customer’s account to the merchant account.

PayPal, Stripe, and Braintree Payments are some of the most common payment gateways that don’t need merchant accounts.

The most significant advantage of a payment gateway is that you won’t have to switch banks. Furthermore, these systems are simpler to incorporate with your online store.

However, there are several drawbacks. For starters, using these payment mechanisms will result in higher transaction fees. Second, a payment gateway directs customers to third-party websites when they make purchases. Some stores’ conversion rates suffer as a result of this.

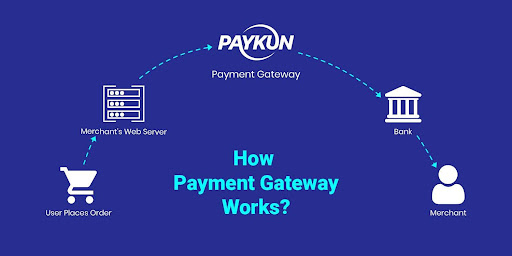

How Does a Payment Gateway Work?

A payment gateway is responsible for securely transmitting confidential cardholder information from the point of sale (POS) to the credit card processor, then back to the POS. It completes three basic steps in this procedure:

Encryption: The payment gateway protocol starts by encrypting the data exchange between the user’s browser and the retailer’s server, ensuring a secure communication path once the process has begun.

Approval: The service then sends an authorization request to the funding source, requesting approval for the transaction to go forward.

Accomplishment: After the permission is granted and the transaction is completed, the interface is oriented to perform the next operation.

What Is a Merchant Account?

A merchant account is the kind of account that allows businesses to accept and process related transactions. The funds from your transactions are deposited there by your payment gateway (or whoever sets up the account for you). The funds are transferred directly from your merchant account into your banking account you set up for yourself, according to a schedule defined by your payment gateway.

A merchant account differs from a company bank account, which is sometimes misunderstood. Your merchant account is merely a holding account for deposits; you have no power over it.

There are times when you may have to return the goods; at such times, you might have to return some of the money as a vendor. This adds a degree of risk to your transactions. Returns are deducted from whatever funds are in your merchant account at the moment, and the balance is transferred to your bank account.

It’s also possible that your payment gateway is accumulating deposits from various sources. Instead of offering you five separate deposits, it gathers them in your merchant account and combines them into a single deposit for your bank account, making reconciliation more straightforward.

A variety of fees can be associated with a merchant account, not all of which are always clearly indicated in contracts, such as:

- Fees for applications

- Fees for setup

- Monthly charges

- Rate of discount

- Fees for each transaction

- Fees paid across borders

- Fees for using a credit card terminal on a rental basis

Payment Gateway vs. Merchant Gateway: Which One is the Best for You?

With the introduction of credit cards, merchant accounts have been with us for some time now. Setting up a merchant account will maximize your cash flow in the company if you’re a retailer who sells mainly through brick-and-mortar stores.

Payment gateways, on the other hand, are suitable for e-commerce and other mobile retailers. The retailers can conveniently enter and accept their mobile devices’ credit card information when you use a payment gateway.