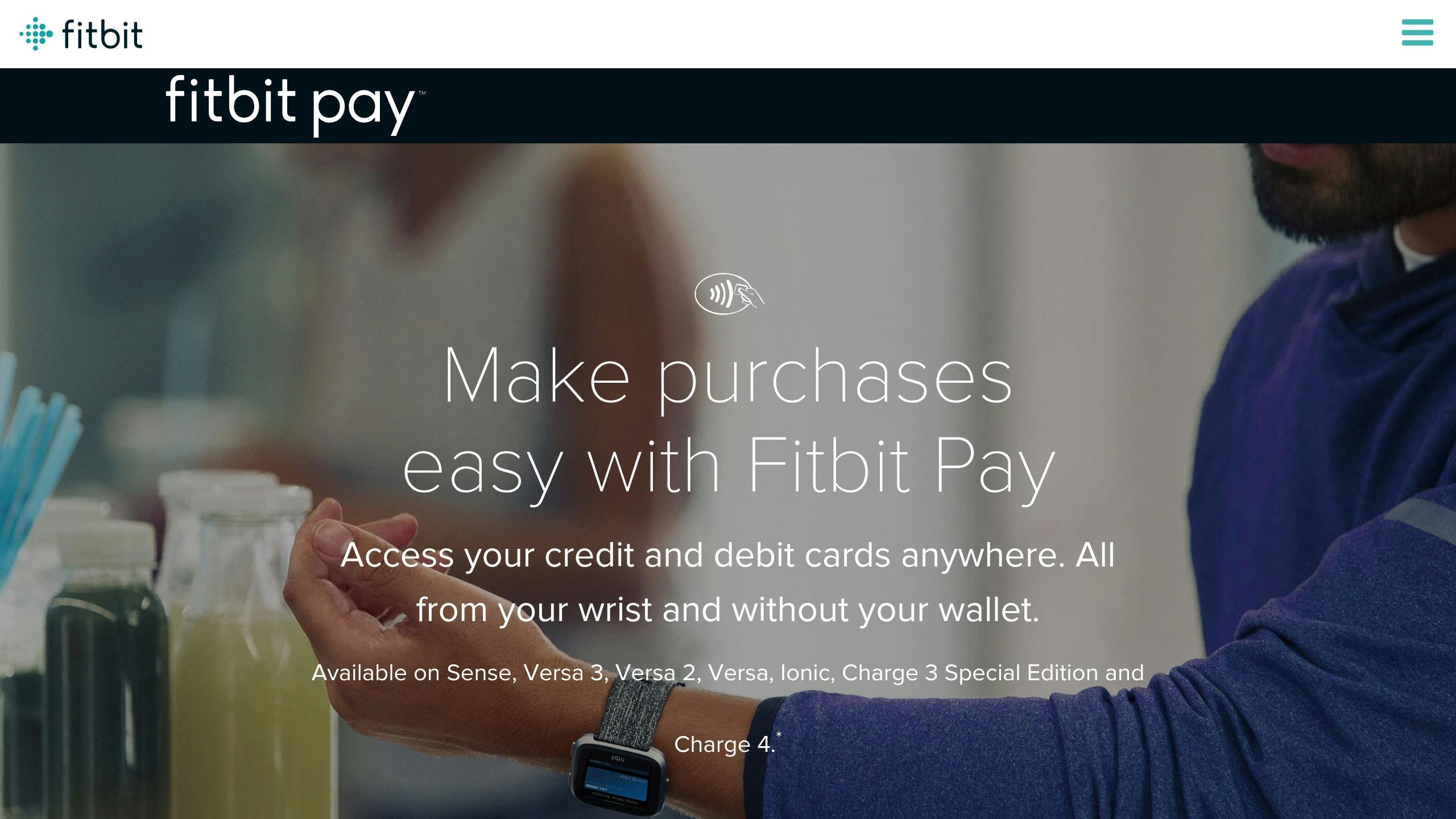

Payment-enabled fitness trackers let you track your health and make secure, contactless payments – all from your wrist. Here’s how they work:

- NFC Technology: These devices use NFC (Near Field Communication) to connect with payment terminals for seamless transactions.

- Security Features: Payments are encrypted and protected with tokenization and biometric authentication (like fingerprints or facial recognition).

- Convenience: Pay for gym fees, transit rides, or retail purchases without carrying a wallet or phone.

- Setup: Add payment cards through the companion app, secure your device with a PIN, and enable biometric verification.

These trackers combine fitness and payment functionality, making daily life easier while keeping your data safe.

How to Set Up Fitbit Pay on Fitbit Charge 5 (Step-by-Step)

Core Payment Technology

Payment-enabled fitness trackers combine secure transaction methods with efficient processing to meet modern market needs. These technologies ensure payments are both safe and easy to complete.

NFC Payment Systems

Near Field Communication (NFC) is the key technology behind contactless payments in fitness trackers. It creates a secure wireless connection between the tracker and an NFC-enabled payment terminal when they are close (about 1.5 inches). Here’s how it works during a transaction:

- The tracker detects the NFC terminal

- Encrypted payment data is transmitted

- The transaction is processed

- A confirmation, like a vibration, is sent to the user

NFC ensures secure data transfer, working with strong protection measures to keep transactions safe.

Payment Data Protection

To secure payments, fitness trackers rely on encryption and tokenization. Instead of transmitting actual credit card numbers, they use unique digital tokens to protect sensitive information.

"We work with you to make payments less confusing, not more." – Secured Payments [1]

Partnerships with payment processors like Secured Payments provide businesses with safe and reliable transaction solutions tailored to their needs [1].

Biometric Security

Biometric verification adds another layer of protection. It ensures only the authorized user can complete a transaction. In some cases, re-authentication is required to confirm the user’s identity before payment.

Device Setup Guide

Set up your device for payments by adding cards and enhancing security.

Linking Payment Cards

- Open the official app.

- Go to the wallet or payment section.

- Tap "Add New Card."

- Enter your card details.

- Confirm ownership through a text message or email.

- Choose the card as your default payment method, if needed.

You can securely store multiple cards using Secured Payments’ system.

Now, let’s make sure your device is protected.

Security Setup

Follow these steps to secure your device:

- Create a 4-6 digit PIN for device access.

- Set a separate PIN for payment transactions.

- Turn on biometric verification (like fingerprint or face recognition).

- Activate auto-lock to secure your device after a period of inactivity.

sbb-itb-8c45743

Making Payments

Payment Steps

Here’s how to make a payment using your tracker:

- Wake up the payment screen on your device.

- Authenticate yourself with your PIN or biometrics.

- Place your wrist near the payment terminal.

- Wait for a confirmation notification.

You’ll get a notification once the transaction is complete. Keep your wrist steady until the payment is confirmed through the Secured Payments network.

Payment Security Features

Your fitness tracker is designed with multiple layers of security to keep your payments safe:

- Encrypted transactions: All payments are encrypted to protect your data.

- Biometric authentication: Payments require your biometric verification for added security.

These features work together to ensure your payments are both secure and easy to complete.

Security and Advantages

Payment Encryption

Fitness trackers with payment features use strong encryption methods to protect your transactions. By combining encryption with tokenization, they ensure your data stays secure. Tokens are transmitted via secure NFC channels during transactions, keeping sensitive information out of reach.

Lost Device Protection

If your fitness tracker is lost, you can safeguard your payment details by following these steps:

- Log into the companion app linked to your device.

- Choose the "Lost Device Protection" option.

- Freeze payment features and notify your card issuer.

Business Integration

These security measures also benefit businesses. Merchants can easily accept payments from fitness trackers using NFC-enabled payment terminals, requiring little to no extra hardware. These systems not only simplify transactions but also support loyalty programs, allowing customers to earn and redeem rewards during purchases. This setup improves the overall shopping experience and strengthens customer loyalty.

Conclusion

Payment-enabled fitness trackers combine health tracking with secure contactless payment features. They rely on technologies like biometric authentication, tokenization, and encryption to ensure every transaction is protected.

This contactless payment feature makes everyday purchases easier while supporting an active lifestyle. As these devices continue to advance, they open up new possibilities for consumers and businesses by leveraging NFC-based payment systems designed with both security and convenience in mind.

With the increasing use of contactless payments, these trackers are becoming an important part of digital transactions. This progress brings us closer to a more connected payment system. Merchants can securely adopt these innovations through trusted providers like Secured Payments, taking a step toward a more seamless payment experience.

FAQs

How do fitness trackers with payment features keep my financial information safe?

Fitness trackers with payment capabilities use advanced security technologies to safeguard your financial data during transactions. These devices typically rely on encrypted Near Field Communication (NFC) technology, which ensures that your payment information is securely transmitted without exposing sensitive details.

Additionally, many fitness trackers utilize tokenization, replacing your actual card details with a unique, temporary code during transactions. This adds an extra layer of protection, making it nearly impossible for your financial information to be intercepted or misused.

For businesses looking to streamline payment processes, tailored solutions like those offered by Secured Payments can provide reliable and secure transaction services designed to meet diverse needs.

What should I do to prevent unauthorized payments if I lose my fitness tracker?

If you lose your fitness tracker, act quickly to prevent unauthorized payments. First, contact your bank or card issuer to report the loss and temporarily disable the payment feature associated with your tracker. Many banks offer mobile apps or customer service hotlines to assist with this.

Additionally, check if the fitness tracker’s app allows you to remotely disable payments or unlink your card from the device. This can often be done through the app’s settings. Taking these steps promptly can help secure your account and prevent any unauthorized transactions.

Can I use my payment-enabled fitness tracker while traveling abroad, and are there any restrictions I should know about?

Yes, you can generally use payment-enabled fitness trackers internationally, but there are a few things to keep in mind. First, ensure that your fitness tracker supports NFC (Near Field Communication) and that the country you’re visiting has compatible contactless payment systems. Most modern fitness trackers work with major payment networks, but availability may vary depending on the region.

Additionally, check with your bank or card issuer to confirm that your payment method is activated for international use. Some banks may apply foreign transaction fees, and certain regions might have limitations on contactless payment amounts. Preparing ahead can help ensure a smooth experience while using your tracker abroad!